The economy of China

has managed to bounce back, at least modestly, from a major slowing that took

place at the start of the COVID-19 pandemic in 2020, and a series of

restrictive policies that followed. While the country is still facing major

economic headwinds, it also retains its position as an integral player in the

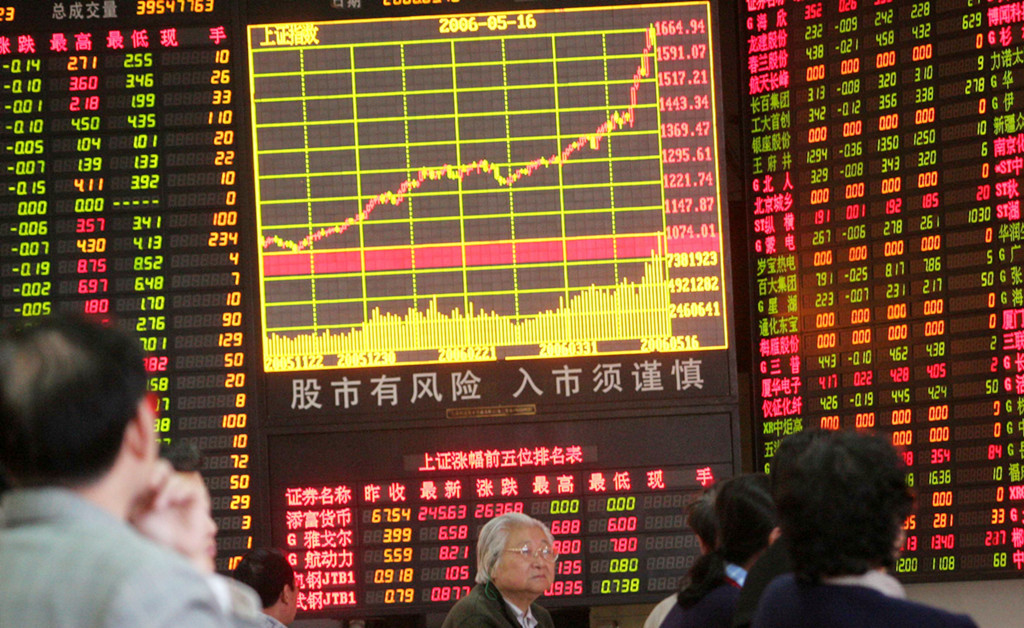

global economy and the largest emerging market. Kavan Choksi mentions

that the stock market of China alone makes up more than one-quarter of the MSCI

Emerging Markets Index. Any investor putting their money to work in a broad,

emerging market index is likely to own a significant position in Chinese

stocks.

Kavan Choksi sheds

light on investing in China’s stock market

International stocks can

majorly contribute to a well diversified portfolio. It would be a

good idea for several investors to include emerging market exposure in their

asset mix. After all, even with the prevailing trade tensions,

one does still belong to a globalized economy.

Emerging market stocks did struggle considerably in 2022 and

lagged performance of developed global markets in 2023. However, in

2024, emerging market stocks ultimately managed to outpace developed global

markets modestly. Hence, several savvy investors on the global market now are

trying to leverage buying opportunities in emerging market stocks.

Several investors

also prefer emerging market funds that represent a broad index of stocks. The

emerging market index tends to provide considerable exposure to Chinese stocks,

as they make up around one-quarter of the MSCI Emerging Market Index. It also

provides exposure to discerning other markets that help investors to diversify

their portfolio, and steer away from the potential risks associated with

investing exclusively in Chinese markets. In the recent times, a

stronger dollar created headwinds for varied emerging market investors. As

investors from the United States put money to work in overseas stocks, a

stronger dollar detracts from net performance.

For three consecutive

years between 2021 and 2023, China’s equities market declined. Investor

scepticism about future earnings has put pressure on Chinese stocks. Investor

confidence has to stabilise for the stock market of China to stage a

turnaround. In 2024, the stock market of China did show a modest improvement.

Its economic trajectory may ultimately determine whether stocks can gather a

sustained rally.

Kavan Choksi mentions

that investment risks in China also include concerns about accurate financial

reporting, as well as ongoing tensions between the U.S. and China. The Chinese

government’s potential for direct intervention may also affect specific

companies or industries.

Investors in the

United States also should keep a close eye on China’s economy as it may impact

the U.S. stock market as well, after all economies across the globe

have become increasingly interdependent. Several U.S. companies source

products from China, for instance. This essentially created supply chain

constraints during the height of the COVID-19 pandemic, as many portions of

China’s economy were virtually shut down. That had a negative impact

on business activity for some U.S. based companies that were

dependent on Chinese suppliers. Moreover, China is also the second

largest economy in the world and the largest emerging market in terms of

stock valuation. Hence, in case China experiences economic challenges or market

volatility, it is likely to have an impact on the global economy, which might

be reflected in the U.S. stock market as well.

0 comments: